‘at the ATM’

courtesy of ‘volcanojw’

It’s easy to think of identity theft and credit card fraud happening to other people– people who aren’t observant in the ATMs that they use, or people who are careless with their PIN numbers, for example– but trust me, it can happen to anyone. This past weekend I returned from a wonderful week-long trip to Italy that was completely relaxing and perfect. But on Sunday, I opened up my checking account online and saw that my entire account had been cleared out while I was gone. I’ve become a victim of identity theft, and I’m here to tell you how to avoid it. Skimming has been spotted in DC, as well as waiter-based theft, and since we live in a tourist-heavy city, we could all use a refresher on how to keep our financial information secure.

In my case, I had used an ATM in Rome that had a skimmer on it, enabling some Italian thief to have access to my credit card number and my PIN number while I took out a couple Euros. And s/he used that number and PIN to withdraw several hundreds of dollars a day for the next seven days, until the balance in my checking account reached $2. While my bank has been very helpful in opening a fraud investigation and replacing the disputed funds, the entire situation has been a giant headache and really took away from the relaxing nature of my trip. So what did I do wrong?

‘Piazza Navona at Christmastime’

courtesy of ‘oneillsdc5’

First of all, I was in a foreign country, in a big tourist area (Piazza Navona). And the ATM I used had a line of about 5 people, all tourists, waiting to use it. Clearly the skimmer guy knew what he was doing. I was unfamiliar with my surroundings, desperate for an ATM, and I had no reference for what an Italian ATM should look like– I practically had a target on my back. Lesson #1: Avoid ATMs in tourist-y areas, if you can.

My second mistake: using an ATM that had a skimmer on it. I’ve replayed the whole event in my mind time after time, and I still don’t think that anything looked strange about that ATM. But here are some things to keep an eye out for: strange gray boxes with a small hole hiding a tiny camera, a dip-reader in a place where a motorized reader should be, or anything that looks like an addition to the ATM (like something that’s been glued on). The Consumerist has a great article that shows pictures of what these things can look like, and Popular Mechanics lists some warning signs to keep an eye out for. Lesson #2: Keep an eye out for things that look sketchy on ATMs.

My third mistake was not keeping in touch with my bank. I called them before I left the country to let them know that I’d be traveling overseas, but while in Italy I kept my phone off to avoid roaming charges. When I returned to the United States, I had a voicemail waiting from my bank, telling me that they’d noticed suspicious behavior in my account. Thinking that it was just some mistake having to do with me traveling outside the US, I didn’t log in to check my account for a few days, which cost me another thousand dollars or so. Lesson #3: Keep in touch with your bank. Make sure they have a number to reach you, and return their calls– they know what fraud looks like, and they’re very good at tracking it.

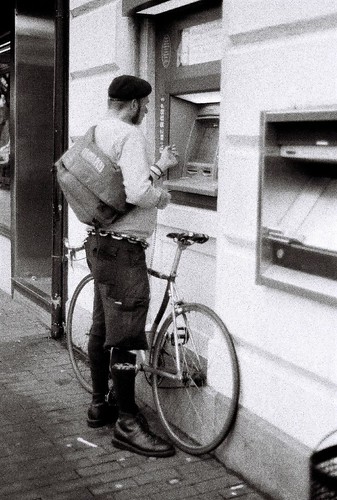

‘Working the ATM’

courtesy of ‘Kai Hendry’

So what did I learn from this ordeal? First off, no one is immune to this sort of thing. I consider myself pretty tech-savvy and not easily duped, but I was scammed. My boyfriend also used this ATM, and he’s a big tech nerd, and he had no idea something was amiss. Be very careful about the ATMs that you use. Also, check your account online (from a secure computer, of course) regularly to make sure there aren’t any unauthorized charges showing up. And if something looks suspicious in your account, call your bank with any questions.

There are a number of other things you can do to protect your identity and financial information as well, including protecting your Social Security number, minimizing the number of credit cards you carry with you, and always covering the hand that is entering your PIN number with your other hand. Now that I’ve got most of my money back from my bank, and their fraud investigation is underway, life has generally returned to normal. But what should have been a post-vacation relaxation period became a nightmare, and I wouldn’t want anyone else to have to go through this.

oh no, shannon! i’m sorry that happened to you.

The Federal Trade Commission has excellent materials on ID Theft, including a step by step guide of what to do if you become a victim.

http://www.ftc.gov/bcp/edu/microsites/idtheft/

So sorry that happened to you. I experienced something similar recently. I live in a touristy town, and had a particularly vile server at a restaurant.

I’m pretty certain she lifted my debit card number, as I got nailed with online purchases that someone made with my information.

Funny thing was, I checked my account and saw strange charges pending. But when I called my bank, they said maybe those charges would “fall off” and not go through.

Yeah, no such luck — they all went through and made other (legitimate) transactions bounce. It was a nightmare. It’s all fixed now but MAN was that an inconvenience.

Happened to me last month…$1000 taken out in Adams Morgan, read my account at PoP

http://www.princeofpetworth.com/2009/12/dear-pop-be-careful-of-atm-skimming-in-adams-morgan/

This happened to me in December. I had $1,400 taken out in Farragut Square and Dupont Circle in the course of two days. The only explanation that makes sense to me is skimming, since I never lost my card.

One thing that I always do is I try to only use ATMs at banks. The security around there is usually better, and the bank generally keep a better eye on the ATMs. Of course, this didn’t stop me from being a victim, so I guess it only goes so far.

My best piece of advice is to keep a close eye on your account and report thefts immediately. Although the process of filing a complaint and waiting for the bank’s investigation is hard and time-consuming, it’s one of your last lines of defense and it works.

You could of course give up ATMs entirely and only withdraw in person. I’m thinking of doing that … but it’s pretty inconvenient.