We’ve had some discussion here at DC Metblogs about the Maryland legal brouhaha over Walmart and their providing (or not) of health insurance. In fact that might have been one of the most commented-upon posts of January, so I know it’s a subject of some interest to our readers. Well, today brings us a Washington Post Business section article about Walmart’s interest in entering the banking market. This is a subject near and dear to my heart since it touches upon on of the things I loathe most in life: bank fees

This post appeared in its original form at DC Metblogs

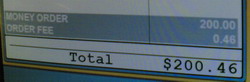

The article quotes Charles Fishman, who speculates on the impact Walmart’s entry into banking would have: “I’ll bet ATM fees would come down pretty quick.” I think that’s a fair bet. In the Walmart near me there’s a kiosk I noticed last month when returning something. It’s somewhat off to the corner, but it’s got five main offerings on this banner over the top of it. The no-fee ATM makes sense – get some money and spend it there. What about the money order purchases, though? I punched up one just to see how the fees compared and this is what I got.

At $0.46 that’s less than the $0.95 you’ll pay at the US Post Office, a place that has much shorter hours and almost always has longer lines. So if you’re looking for a money order you can’t find a fee-free PNC ATM, you may want to check your Walmart.

This post appeared in its original form at DC Metblogs